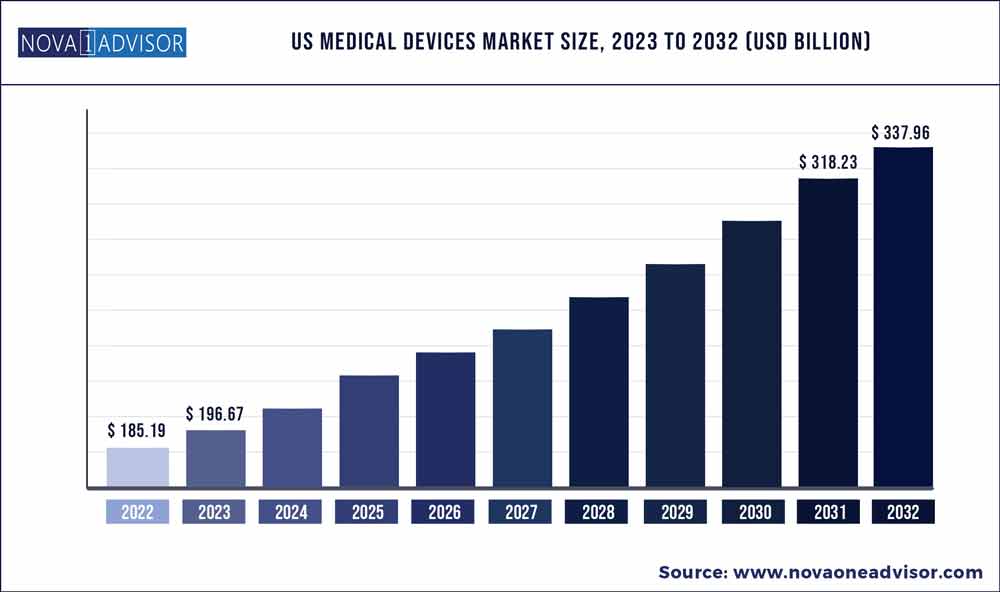

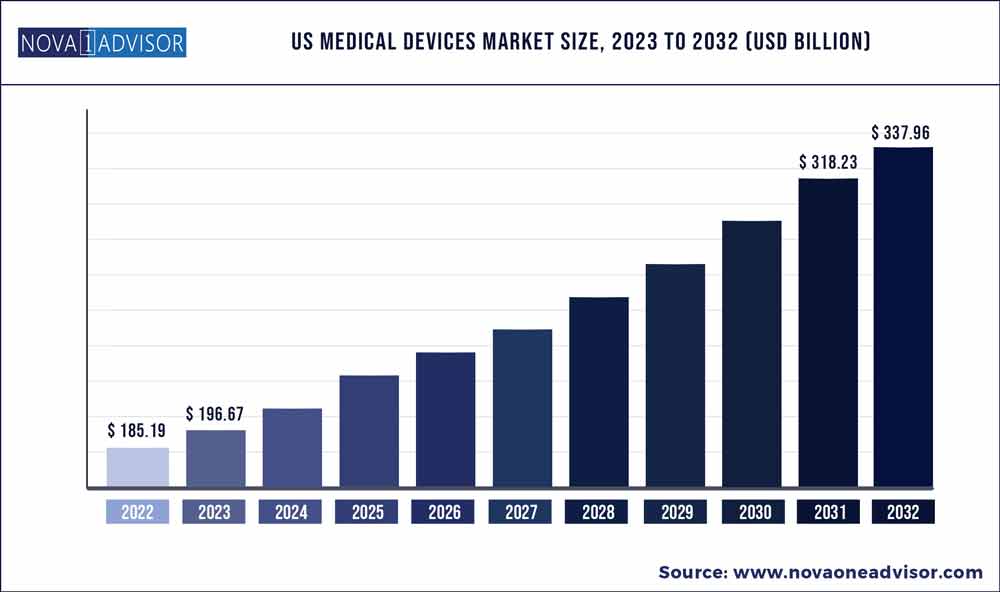

The U.S. medical devices market size was exhibited at USD 185.19 billion in 2022 and is projected to hit around USD 337.96 billion by 2032, growing at a CAGR of 6.2% during the forecast period 2023 to 2032.

Key Takeaways:

- By end-user, the hospitals and clinics segment has accounted 89.9% of the total revenue share in 2022.

- The diagnostics centers segment is growing at a CAGR of 10.4% from 2023 to 2032.

COVID-19 IMPACT

The COVID-19 pandemic has significantly affected the development and deployment of these devices in the U.S. The restrictions imposed during the pandemic led to the postponement or cancellation of non-essential and elective procedures such as dental, orthopedic, and ophthalmic surgeries.

For instance, a study published by LAC+USC Medical Center revealed that during the initial wave of the COVID-19 pandemic, the average surgical case rate for elective colorectal procedures declined to approximately 2.4 patients/week from an average of 9.2 patients/week in the previous two years. This decline indicates a 75% relative decrease.

Medical device manufacturers providing medical equipment for elective procedures such as diagnostic imaging and dental procedures witnessed a considerable decline in revenues for 2020 as compared to 2019.

For instance, according to Johnson & Johnson Services, Inc. statistics 2020, surgery device sales were USD 8.29 billion in 2020, a decrease of 13.9% from 2019. The decline in advanced surgery was attributed to the negative impact of COVID-19.

However, the increasing patient pool for COVID-19 diagnosis led to increasing adoption of COVID-19 tests compared to decreasing routine IVD tests such as diabetes and cancer screening in 2020. Furthermore, after the pandemic, routine tests regained substantial growth coupled with high demand for COVID-19 tests. Thus, these cumulative factors propelled the in-vitro diagnostics segment share in 2021.

Similarly, leading industry players in the manufacturing of in-vitro diagnostic devices and devices in other segments, such as beds, gloves, masks, respirators, and other hospital supplies, witnessed high demand for these products in 2020 and 2021.

For instance, Thermo Fisher Scientific Inc. generated a revenue of USD 39.29 billion in the financial year 2021, with a growth of 23.0% compared to USD 34.22 billion in 2020. The growth was attributed to high sales of IVD devices during the COVID-19 pandemic.

A growing number of adults and children participating in leisure and competitive sports activities such as cycling, running, and other sports have splurged the demand for activity trackers. Similarly, the rising focus on diagnosis and real-time monitoring of patients by regional and national healthcare agencies has been pivotal in the higher demand for wearable devices.

For instance, according to MSI International survey outcome published in June 2021, 80% of Americans were oriented toward remote patient monitoring. Around half of these Americans favored including it in medical care. Also, according to the same survey, 88% of patients had healthcare performed remotely in the last 12 months.

In October 2021, AliveCor, Inc. announced the launch of AliveCor Labs, an Independent Diagnostic Testing Facility (IDTF) in the U.S. The IDTF helped healthcare providers with enhanced and reimbursed cardiac monitoring services, including access to real-time data to help inform clinical decision-making.

This factor presents enormous opportunities for new entrants, domestic players, and established global market players to focus on this segment and introduce new devices to cater to the ever-increasing demand. Thus, the population's sheer size and the country's potential market aids entrants in providing remote monitoring devices at competitive pricing.

U.S. Medical Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 196.67 Billion |

| Market Size by 2032 |

USD 337.96 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 6.2% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product, Therapeutic Application, End User, |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott (U.S.),Johnson & Johnson Services, Inc. (U.S.), Stryker (U.S.), BD (Becton, Dickinson, and Company) (U.S.), Boston Scientific Corporation (U.S.), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche AG (Switzerland), Danaher (U.S.)

|

The U.S. has witnessed substantial growth in the geriatric population over the years. A demographic research projection published by the University of Washington in July 2021 since the beginning of the 21st century assumed that every other person born in the U.S. will live up to 100 years. The rising geriatric population is leading to the increasing prevalence of age-related disorders such as cataracts, chronic obstructive pulmonary disease, hypertension, osteoarthritis, diabetes, depression, and dementia.

The growing prevalence and increasing cost burden of chronic and lifestyle diseases have led growing emphasis of healthcare agencies, government, and healthcare providers on the timely and routine treatment of patients. Thus, through awareness programs and campaigns, several national and regional healthcare agencies have actively promoted the diagnosis and treatment of common diseases.

This factor increased awareness among the geriatric population toward products and services for diagnosis and treatment, which is presenting a large patient pool undergoing treatment. Further, high treatment rates are driving the demand for these devices in hospitals, clinics, and other healthcare settings.

Additionally, to cater to the growing demand for advanced devices, medical devices companies are now investing in R&D to introduce healthcare devices with various advanced capabilities, such as AI intelligence, 3D imaging, wearable heart rate trackers, and others. Thus, rising launches of such advanced devices and their increased presence across the globe have further propelled market growth.

For instance, in April 2022, Biotricity, a U.S. medical device company, announced the launch of Biotres, a wireless wearable cardiac monitoring device. Biotres is a three-lead device designed to continuously monitor heart activity and record electrocardiogram data for early detection of cardiac arrhythmias.

DRIVING FACTORS

Major industry players are actively investing in the research and development of advanced devices. The presence of potential devices in the end stage of development is expected to boost the demand for these devices.

For instance, in January 2022, Cook Medical received the U.S. FDA Breakthrough Designation for a new drug-eluting stent for below the knee (BTK) to treat patients with chronic limb-threatening ischemia (CLTI).

The U.S. medical device manufacturers with a strong emphasis on R&D are shifting their strategies to introduce devices enhanced with new technologies. Thus, rising investments in R&D and breakthrough technologies to accelerate the manufacturing of these devices are expected to propel the market growth.

For instance, in October 2022, GlucoTrack Inc. announced its plan to expand its product pipeline under its new R&D program for a long-term Continuous Glucose Monitor (CGM). With R&D focus on an implantable glucose management platform, the company will enter the Type I diabetes market.

Therefore, such a robust pipeline of advanced devices and high investments by the manufacturers is anticipated to fuel the adoption of these devices, further propelling the market growth.

RESTRAINING FACTORS

Medical devices have witnessed significant developments in the last decade by integrating new technologies, modifications in design, and updating other parameters. However, these devices' overall cost is higher, including acquisition and maintenance costs. Along with capital-intensive devices, some advanced healthcare devices are associated with various components, including cameras, batteries, chips, sensors, and other accessories that need periodic replacement.

For instance, INUMAC MRI scanner is a neuro disease imaging equipment and can generate a power of 11.75 Tesla, whereas conventional MRI systems generate a power ranging between 1.5-3 Tesla. The development of INUMAC MRI system took seven years and owing to its advanced features and huge investment in R&D, the scanner cost is approximately USD 270 million.

Moreover, the increasing utilization of medical devices with current costs imposes an economic burden on small & mid-sized healthcare facilities such as health clinics, Ambulatory Surgical Centers (ASCs), and imaging centers. Compared to independent hospitals, rising costs in these facilities will further restrain the U.S. medical devices market growth.

For instance, according to American Hospital Association, the hospital supplies expenses for hospitals were 15.9% higher by the end of 2021 compared to 2019. Also, ICUs and medical supplies expenditures were 31.5% higher in 2021 compared to 2019.

Thus, such high medical device costs limit the adoption of these devices, further hampering the demand for these devices and the growth of this industry.

Some of the prominent players in the U.S. Medical Devices Market include:

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Stryker (U.S.)

- BD (Becton, Dickinson, and Company) (U.S.)

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- F. Hoffmann-La Roche AG (Switzerland)

- Danaher (U.S.)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Devices market.

By Product

- Monitoring Devices

- Cardiac Monitoring Devices

- Neuromonitoring Devices

- Respiratory Monitoring Device

- Multi-Parameter Monitoring Devices

- Hemodynamic Monitoring Devices

- Fetal and Neonatal Monitoring Devices

- Temperature Monitoring Devices

- Weight Monitoring Devices

- Diagnostic Devices

- Surgical ENT Devices.

- Endoscopes

- Imaging Devices

- Diagnostic Molecular Devices

- Drug Delivery Devices

- Surgical Devices

- Bio Implants and Stimulation Devices

- Treatment Equipment

- Infusion Pumps

- Medical lasers and LASIK surgical machines

- Others

By Therapeutic Application

- Gastrointestinal surgery

- General Surgery

- Diagnostic Imaging

- Respiratory

- Orthopedics

- Cardiovascular

- Dental

- Neurology

- Ophthalmology

- Ear-Nose-Throat (ENT)

- Nephrology and Urology

- Others

By End User

- Hospitals & Clinics

- Diagnostic Centers

- Research laboratory

- Pharmaceutical companies